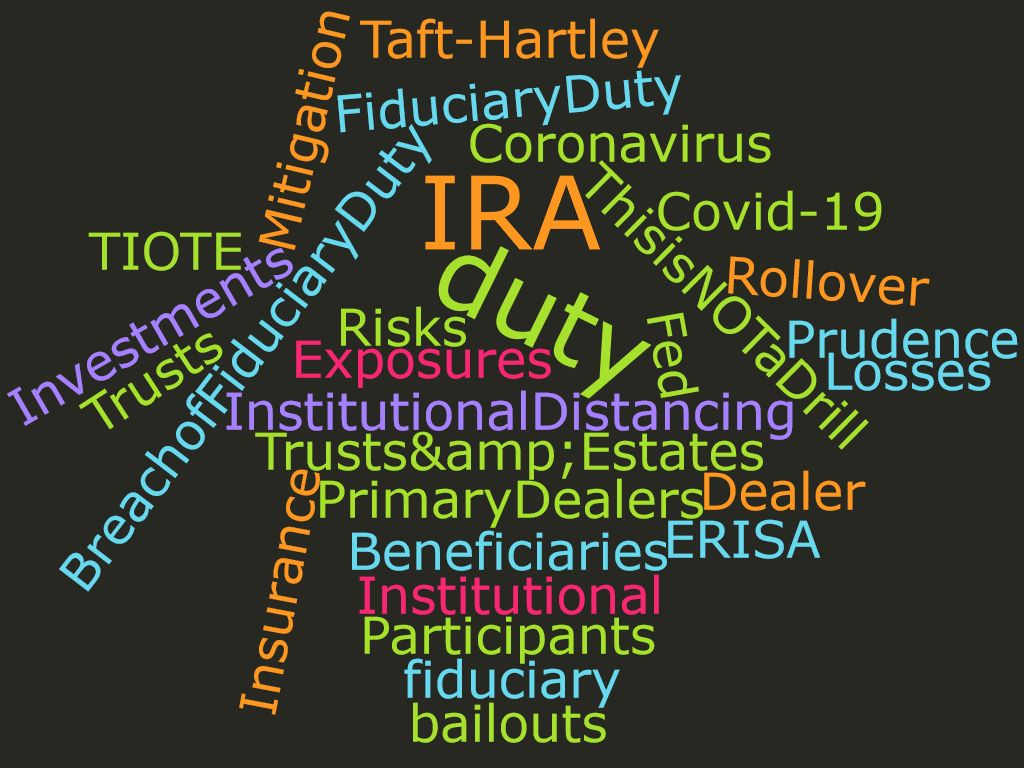

How can you tell? They don’t or won’t talk about much less recommend low-cost passive index funds. And they don’t or won’t talk about or own up to fiduciary responsibility verbally or in writing. They may use esoteric terms (words to impress you, which they often fail to connect to your suitability and or implement) like tactical, strategic or opportunistic asset allocation or certain hedge fund strategies or private equity investments.

How can you tell? They don’t or won’t talk about much less recommend low-cost passive index funds. And they don’t or won’t talk about or own up to fiduciary responsibility verbally or in writing. They may use esoteric terms (words to impress you, which they often fail to connect to your suitability and or implement) like tactical, strategic or opportunistic asset allocation or certain hedge fund strategies or private equity investments.

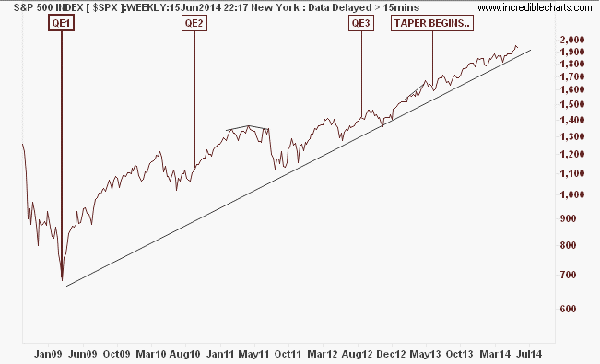

LEVERAGE

They often don’t understand the dangers of leverage in investments (stocks, futures and options), insurance, annuities, strategies, financial statements, the stock or bond market (term used very lightly) or economy (even more so).

http://www.federalreserve.gov/releases/h41/current/h41.htm#content

Financial drug dealers love to talk rather than read prospectuses or private placements of the products and strategies they are supposed to know before recommending to you.

Instead they prefer to soothe you and wax in terms of “relationships” or “value” all the while extracting unnecessary fees from your account. Fees are often (ultimately) the only reason a financial drug dealer will take time out of his and her busy day to talk to you, often a clue of arrogance.

If you are flying solo, there’s less to worry about – just you. If however you are a trustee, then there’s a lot to worry about, starting with you knowing what a fiduciary needs to do. Every decision you make or fail to make will likely be put under a microscope. And if you have the family trust account with a financial drug dealer – your problems may only get worse.

If you feel intimidated by the “investment-ese” perhaps ask them this.

“How do you carry out your fiduciary duty to my account?”

Flag – if you have had your trust, investment, IRA or pension account with the same person or firm – unless you are very careful about fees – there’s a risk you are being fleeced, perhaps for many years. Financial drug dealers like to keep you around to feed their habit – fee, expenses and commissions extraction.

WARNING

If you are invested in ANY active investment, insurance, annuity, asset protection or strategy there is a VERY good chance you and all of your advisers (legal, tax and financial) are working with a Financial Drug Dealer and like all drugs don’t fully understand the effects on your and others’ fiduciary duty.

If you are a trust, IRA or pension beneficiary make sure to send your dad this Father’s Day post.

Get clean – feel better – give your financial drug dealer the shaft.

Happy Father’s Day!

For more information support@fiduciaryexpert.com or (310) 943-6509

Copyright Chris McConnell & Associates 2014 All rights reserved