Is 2007 happening again? This time in bank or leveraged loan funds?

Regarding Bank Loan investment market:

“It will be hard to call the exact move in interest rates because we’re in a massive global monetary experiment that’s never been done before,” he said. “And anybody who tells you where rates are going, you shouldn’t listen to — besides [Federal Reserve Chairman] Ben Bernanke.” Mark Okada, CIO at Highland Capital Management.

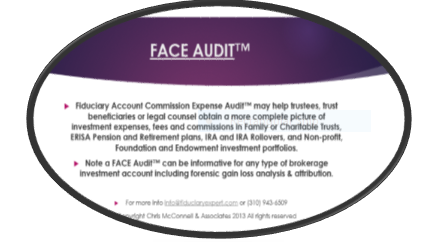

Before you read the rest of the post, we offer a tip for prudent fiduciary account management.

A simple guideline – take 0.10% of the time it took to earn or accumulate your capital to research an investment before investing any money. Example – if it took 5 years (over 1,800 days) to accumulate your investment amount, take 0.10% of that time 1.8 days to do your research and or ask questions and get acceptable answers. On Wall Street and investments in general there is no such thing as a free lunch or something for nothing. In other words, for a potentially greater return you are consciously or otherwise taking on greater risk.

Bloomberg’s recent warning about the “leveraged loan” or bank loan market was preceded by Bankrate’s in January 2014.

Why are bank loans (or so called leveraged loans) problematic investments for trustees and fiduciary accounts?

The market is not automated, far from it. Loans are (as many investors may blindly assume) not securities and therefore lack basic protections of federal and or state securities oversight and regulation. Yet, the size of the market is over $1 Trillion. Investors including public and private pension funds invest for higher yields. Troublesome; the “market” for these loans is taking longer to complete funding or settle trades, contrasted to investors’ expectations they may have faster access and or immediate liquidity to redeem their investments.

This is a when not if problem in the making. Indeed the “market’ for Bank or Leveraged Loans seems to bear many of the same hallmarks as the ill-fated 2007 and 2008 Auction Rate Securities markets; periodic rate resets, LIBOR – based pegs and certain agent banks dominating the so called “market.” Of particular concern, is the lengthening of the settlement process today compared to 2007 despite vast improvements in technology and significant capital in-flows.

“Markets” orchestrated (with scant third party or regulatory oversight) by a few large players and or individuals tend to have harsh, sudden, unfavorable information asymmetries, redolent of the underlying cause of the 2008 Global Financial Crisis (GFC).

The answers to the question: is this the correct investment, asset allocation, insurance, investment policy strategy or course of action, as always and at all times, should only be the result of prudence in action.

For assistance see support@fiduciaryexpert.com or (310) 943-6509

Copyright Chris McConnell & Associates 2004 to 2014 All rights reserved