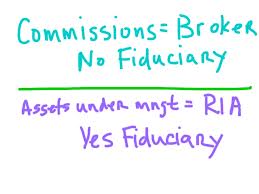

These are the “FIDUCIARY ACCOUNTS”

- ALL trust accounts – family, children’s, grand children’s, GST, charitable, special needs, etc;

- IRA, IRA Rollover, 401K rollover accounts;

- ALL private, corporate ERISA Qualified pension plan, 401k plan accounts;

- ALL public employees’ (state, county, city, agency – fire, police) pension plan accounts;

- ALL union (Taft – Hartley Act), collective bargaining or multi – employer pension plan accounts;

- ALL charity, non-profits, foundations and endowment investment accounts, and their 403b plan accounts;

- HOA (home owners association), Cemetery Trust investment accounts;

- Guardian, Conservator, Coogan Accounts.

- Every investment, asset or life insurance, annuity, real and or intellectual property or closely held business in any of these FIDUCIARY ACCOUNTS is subject to fiduciary duty.

- Any other type (individual, joint, tenants in common, partnership, etc.) of account, depending on the facts and circumstances may become subject to fiduciary duty; this can arise at any time, encompass any asset, liability, real estate, insurance, annuity, intellectual property copyright, patent, trademark, trade secret and or family / closely – held business.

- The scope of accountability implicit in fiduciary duty per Judge Cardozo, 1928 in Meinhard v. Salmon: A trustee (i.e. fiduciary) is held to something stricter than the morals of the marketplace. Not honesty alone but the punctilio of an honor the most sensitive is then the standard of behavior…

contact@fiduciaryexpert.com or (310) 943 – 6509

© Chris McConnell & Associates 2003 – 2019 All rights reserved