In September 2005 S&P (Standard & Poor’s) issued “Who will be left holding the bag?” in what would turn out to be a prescient report about the housing market and mortgage backed securities. Around the same time certain investment banks created a new mortgage related security called a CDO (collateralized debt obligation, some were cash CDO’s, some synthetic CDO’s and some a cross over, hybrid CDO’s) mixes of certain tranches of Mortgage backed securities (RMBS are also known as REMICs (Real Estate mortgage investment conduit).

The Senate Permanent Sub-Committee on Investigations mentioned “Who will be left holding the Bag” in its report dated April 13, 2011. S&P, along with Moodys’, Fitch and other NRSRO’s assigned their highest ratings (triple A) to mortgage backed securities and CDO’s; later in around 2007 these companies, after mortgage borrowers failed to make payments, “updated” their models and cut credit ratings causing the values of billions of RMBS, CDO’s to decline substantially. As before the 2008 Financial Crisis, still today credit ratings are paid for by the issuers of securities.

Today the Fed is holding a very large part of the functional bag in the amount of over $3T of securities on its balance sheet.

This was not as some have asserted a “sub-prime” or “CRA (Community Reinvestment Act)” problem. If all $1.2T sub-prime issued mortgages became worthless (and they didn’t) the bailout would have ended there – and it didn’t. Banks and only banks approved each and every mortgage; it’s important to point out that no borrower coerced any bank into approving a mortgage.

In 2005 and 2006 we issued FiduciaryALERT #2 and #3 briefly but directly advising trustees and fiduciaries to evaluate the assets in trust especially real estate, due to leverage (implicit and explicit), fixed income, bond market – linked investments, due to then and now record low artificial, transient interest rates and financial statement transparency.

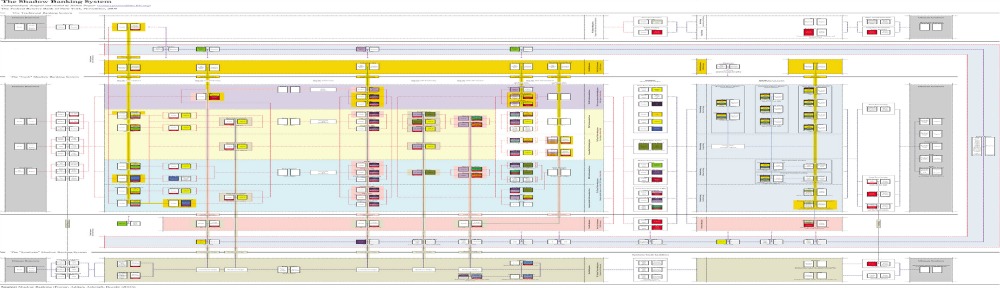

A few words about leverage – leverage is the use of borrowed money to control an asset; a house purchased with a 20% down payment is 4 times leverage for the borrower, the next most common is a stock margin account under Reg T and the most dangerous bank’s and certain financial entities (like hedge funds, private equity funds) or other institution’s leverage – controlling assets which are not fully paid for. For whatever reasons, we may be confronting even larger counter-party risks now and in the future. Financial institution’s or entities’ leverage is dis-intermediation; a root, if not the sine qua non of the 2008 financial crisis.

Trustees are advised to consult independent, experienced, qualified, conflict-free advisers and carefully document all of their major decisions, including “stay the course”. In the future, trust beneficiaries may be asking some serious questions in litigation; trustees would be wise to be prepared.

For more information info@fiduciaryexpert.com or (310) 943 – 6509

When you consult the Fiduciary Expert, you’ll know what you don’t know

© Chris McConnell & Associates 2003 – 2013 All rights reserved.